Since its launch in 2016, FMC has capitalized over $500M worth of real estate, including over 2,700 multifamily units and 130,000 commercial square feet, raising over $140M of equity in the process.

The Flats at Dunlap

aka Hickory Ridge Apartments

Peoria, IL

Acquired: May 2022

Asset Type: Multifamily

YOC: 1978

204 units

Purchase Price: $15M

The Meridia Apartments and Birdcage Garage

Tulsa, OK

Acquired: Feb 2022

Asset Type: Multifamily

YOC: 2017

93 units

Purchase Price: $27.25M

District at 6th

Des Moines, IA

Acquired: Oct 2021

Asset Type: Multifamily

YOC: 2020

213 units

Purchase Price: $40.75M

Scenic Woods

Manhattan, KS

Acquired: July 2021

Asset Type: Multifamily

YOC: 2012

144 units

Purchase Price: $14.75M

River’s Edge at Manchester

Richmond, VA

Acquired: April 2021

Asset Type: Multifamily

YOC: 2018

212 units

Purchase Price: $47.5M

View Property

Avalon Springs

Louisville, KY

Acquired: April 2020

Asset Type: Multifamily

YOC: 2018

141 units

Purchase Price: $22.0M

View Property

Landon Creek

Greensboro, NC

Acquired: February 2020

Asset Type: Multifamily

YOC: 2019

72 units

Purchase Price: $8.7M

View Property

The Bricks Waukee East

Waukee, IA

Acquired: December 2019

Asset Type: Multifamily

YOC: 2017

216 units

Purchase Price: $25M

View Property

Old Mill Townhomes

Lynchburg, VA

Acquired: July 2019

Asset Type: Multifamily

YOC: 1975

156 units

Purchase Price: $10.75M

View Property

Northridge Village Apartments

Roanoke, VA

Acquired: January 2019

Asset type: Multifamily

YOC: 1970

174 units

Purchase Price: $11.45M

View Property

The Cove at Peter’s Creek

Roanoke, VA

Acquired: January 2019

Asset type: Multifamily

YOC: 1974

60 units

Purchase Price: $2.4M

View Property

Aspire Townhomes

West Des Moines, IA

Acquired: December 2018

Asset type: Multifamily

YOC: 2017-18

222 units

Purchase Price: $40.25M

View Property

Foot of the Mountain Motel

Laurel Pines Apartments

Richmond, VA

Acquired: March 2017

Purchase Price: $10.56M

Asset Type: Multifamily

YOC: 1988

120 units

Sold: January 2023

Exit Price: $21.0M

Deal Level IRR (realized): 29.6%

Frontier Apartments

Acquired: March 2017

Purchase Price: $10M

Asset type: Multifamily

YOC: 1972

182 units

Sold: December 2020

Exit Price: $17.25M

Deal Level IRR (realized): 39.5%

The Argyle Apartments

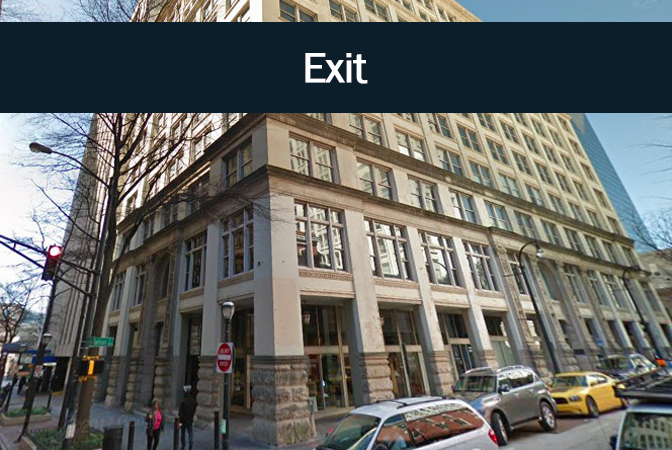

The Grant Building

FMC Principals Prior Transactions

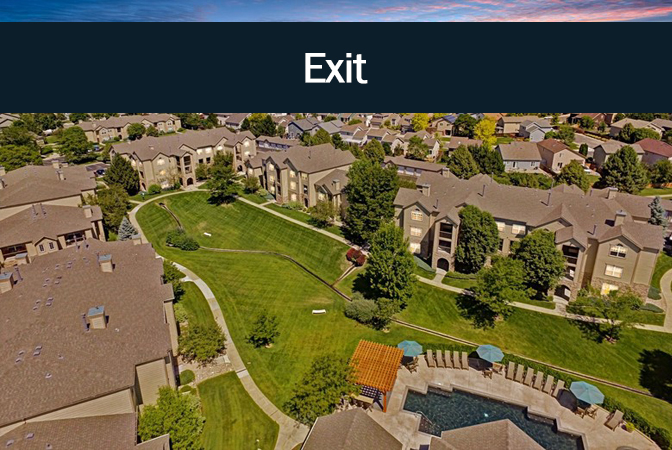

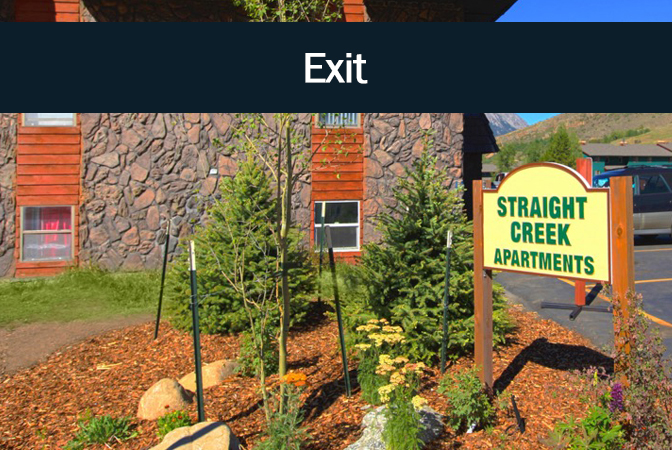

Straight Creek Apartments

Straight Creek Apartments

Dillon, CO

Acquired: July 2015

Purchase Price: $10.0M

Asset type: Multifamily

YOC: 1971

79 units

Sold: November 2020

Exit Price: $22.25M

Deal-Level IRR (realized): 31.3%

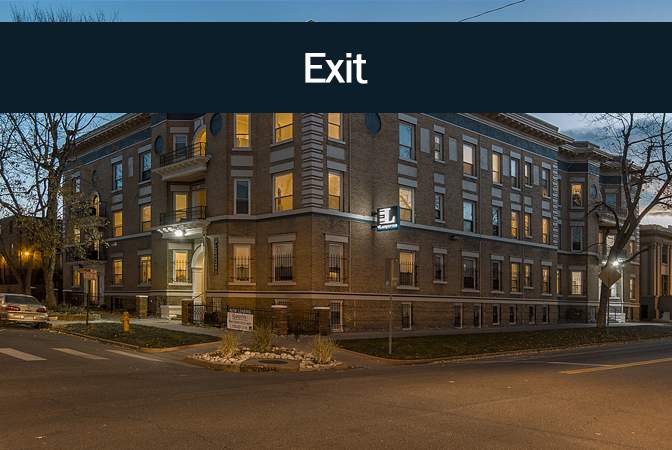

The Lafayette